The Best Scalping Technique for Beginners

Wiki Article

Not known Details About The Best Scalping Technique

Table of ContentsThe Best Guide To The Best Scalping TechniqueThe smart Trick of The Best Scalping Technique That Nobody is Talking AboutThe Definitive Guide to The Best Scalping TechniqueHow The Best Scalping Technique can Save You Time, Stress, and Money.Some Known Questions About The Best Scalping Technique.

Scalpers seek to benefit from little market activities, benefiting from a ticker tape that never stands still. For years, this fast-fingered day-trading group depended on Degree 2 bid/ask screens to situate buy and also offer signals, checking out supply and also demand discrepancies away from the National Best Quote and Offer (NBBO)the bid/ask cost that the average person sees. The signals utilized by these real-time tools are comparable to those made use of for longer-term market strategies, but instead, they are used to two-minute charts.An immediate exit is called for when the indication crosses as well as rolls versus your placement after a rewarding drive. You can time that departure much more specifically by enjoying band communication with price.

Take a timely departure if a price drive falls short to get to the band however Stochastics rolls over, which informs you to obtain out. Once you fit with the operations and also interaction in between technological elements, do not hesitate to change standard deviation greater to 4SD or lower to 2SD to account for daily adjustments in volatility.

Pull up a 15-minute chart with no indications to maintain track of background problems that may influence your intraday efficiency. Add three lines: one for the opening print and also 2 for the low and high of the trading variety that established in the initial 45 to 90 mins of the session. The Best Scalping Technique.

Little Known Facts About The Best Scalping Technique.

Scalpers can no much longer depend on real-time market deepness evaluation to obtain the buy and market signals they need to book several small profits in a typical trading day.The stock exchange is understood for fast-paced heights and also valleys. Lots of investors gain respectable earnings taking advantage of this volatility. Some also trade their means from dustcloth to treasures. One typical way to tackle trading is referred to as scalping a busy trading method that entails making a multitude of trades, each causing little profits.

As well as they're a great deal cooler than Jeff Bezos. These investors target high-liquidity stocks as well as various other assets those that can be dealt in the blink of an eye because time is important with this method. As quickly as small price movements press the possession to the scalp trader's profit objective, the investor sells the placement and carry on to the following.

The Best Scalping Technique Can Be Fun For Anyone

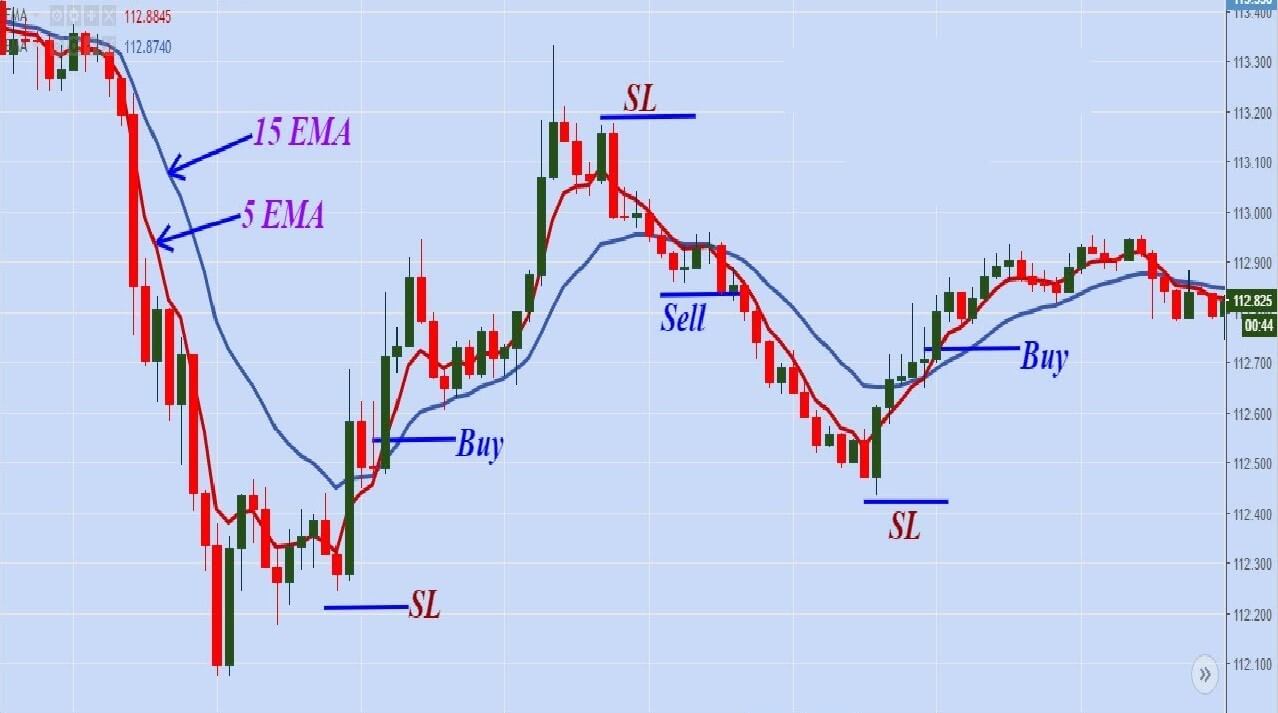

Only stocks with high trading quantity are taken into consideration for this approach. Price activity is key to any effective click here to find out more trade, and the scalp-trader wants points to take place swiftly. These traders search for stocks with high levels of volatility, indicating they are known click here to find out more for busy cost variations. As soon as a supply or team of supplies is selected, the trader carries out technological analysis to figure out the very best entrance points.When searching for a strong entrance, the investor makes use of real-time charts with a brief time framework, utilizing tick or one-minute charts to examine price actions. When scalpers see chances, they enter the professions, keeping their computer mice on the "sell" button, all set to squander at the very first sign of revenue.

Investors commonly utilize several moving standards set to various period as well as search for crossovers. When a short-term SMA goes across over a long-term SMA, it recommends that the supply is likely to relocate up (The Best Scalping Technique). Alternatively, when the short-term SMA goes across below the lasting SMA, it suggests the stock is likely to move downward.

Fascination About The Best Scalping Technique

Investors look for crossovers as an indicator of transforming energy. When the MACD line crosses over the signal line, the signal is bullish.Traders use the stochastic oscillator to get signals straight prior to motions take place in the market. The scalp trading method is see this exciting yet dangerous.

Constantly be ready to act. Adjustments happen quickly in the market, so you can't take your eyes off the ball.

It's hectic, it can lead to remarkable profits, and also it's a relatively basic technique to deploy. As with any kind of other temporary trading technique, scalp trading comes with a high degree of threat.

Not known Details About The Best Scalping Technique

Just like any kind of various other trading method, the scalping technique comes with its own listing of pros and cons that need to be attentively taken into consideration prior to diving in. There are a number of advantages to scalping in the supply market. Several of the most significant consist of:. Scalping takes place rapidly based solely on price motions, so there's no requirement for in-depth essential analysis or other difficult study regarding the assets you're trading.If you have the technological evaluation skills as well as an eager understanding of exactly how the market works, you might become the following significant success. As a fast-paced method, scalping requires traders to regularly seek the following opportunity and maintain an eye on open trades. Several traders discover it an interesting method to maintain themselves busy while generating income in the market.

Although there are a lot of factors to be thrilled regarding obtaining begun with this trading approach, there are also a couple of considerable drawbacks to scalping. Traders financial institution on tiny cost changes as well as tiny earnings. That indicates one negative mistake that leads to a big loss can be adequate to erase your whole trading day's earnings or more!.

Report this wiki page